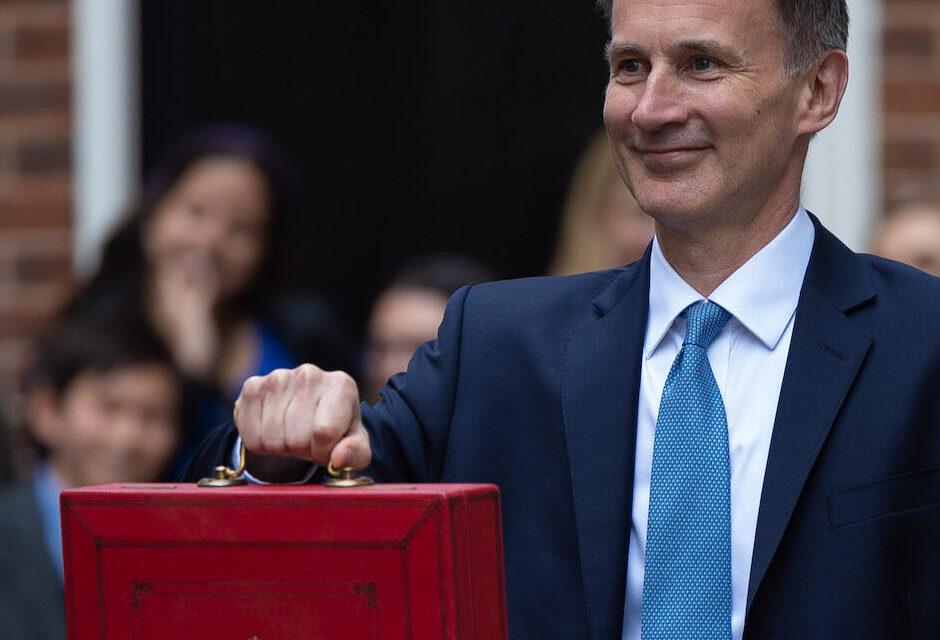

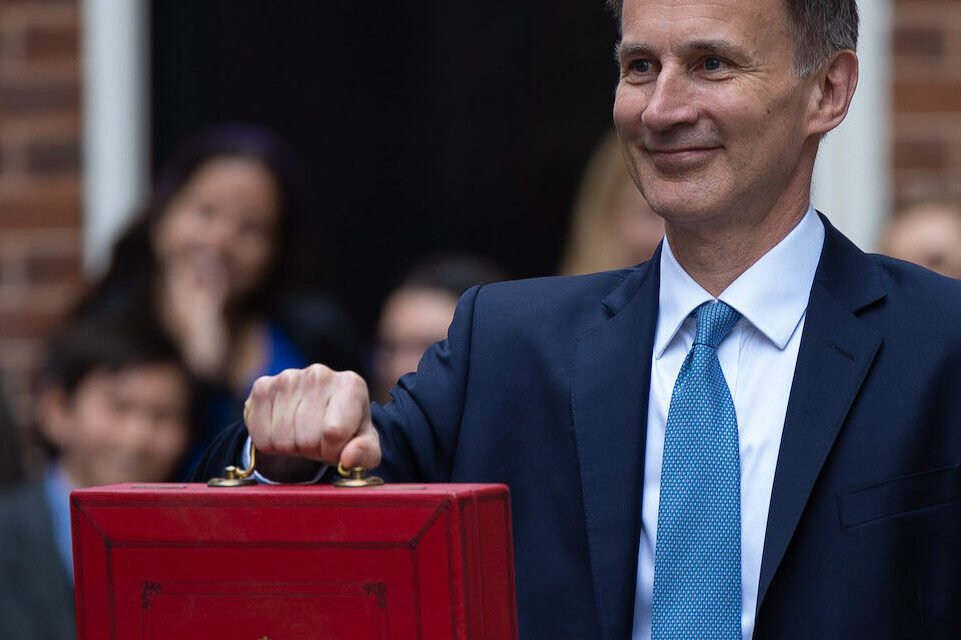

UK chancellor Jeremy Hunt on his way to deliver the 2023 spring budget. Credit: Simon Walker / No 10 Downing Street/ Flickr

The main bullet points from today's budget, as the Office for Budget Responsibility (O.B.R.) says inflation will drop to 2.9% by the end of the year. -

- On business taxation, there will be a new policy of "full expensing" for next three years, with intention to make it permanent

- Enhanced credit for small and medium-sized businesses that spend on R&D - a £1.8bn package of support

- Corporation tax up from 19% to 25%

- Pensions annual tax-free allowance upped by 50% from £40,000 to £60,000

- £1m lifetime allowance abolished on pensions savings

- Pilot of incentive payments of £600 for childminders who sign up to the profession, rising to £1,200 for those who join through an agency

- Funding boost to nurseries providing free childcare under the hours offer by £204m from this September rising to £288m next year

- Childcare costs paid upfront for parents who are moving into work or want to increase their hours. Maximum they can claim upped to £951 for one child and £1,630 for two children

- The government will change minimum staff-to-child ratios from 1:4 to 1:5 for two-year-olds in England but make it "optional"

- All schools in England to offer wrap-around care either side of the school day for children by September 2026.

- Energy Price Guarantee stays at £2,500 for next three months Pre-payment meter charges in line with comparable direct debit charges

- Fuel duty frozen for the next 12 months

- From 1 August, duty on draught products in pubs 11p lower than supermarkets

- 12 new investment zones confirmed - "12 potential Canary Wharfs". If chosen, areas will have access to £80m of support

- £200m invested in local regeneration projects across England £161m for regeneration projects in Mayoral Combined Authorities and the Greater London Authority

- £400m for new Levelling Up Partnerships in areas including Redcar and Cleveland, Blackburn, Oldham, Rochdale, Mansfield, South Tyneside, and Bassetlaw

- Second round of the City Region Sustainable Transport Settlements, allocating £8.8bn over next five-year funding period

- Climate Change Agreement scheme extended for two years £20bn allocated for development of Carbon Capture Usage and Storage. This will support up to 50,000 jobs

- Subject to consultation, nuclear power to be classed as "environmentally sustainable" in green taxonomy "Great British Nuclear" to help nuclear provide one quarter of electricity by 2050.

- UK is launching the first competition for Small Modular Reactors £900m of funding to implement recommendations in independent review for an Exascale supercomputer

- Research and innovation programme of £2.5bn set out in quantum strategy

- Prize of £1m a year for 10 years to ground-breaking AI research - the Manchester Prize White paper to be published on disability benefits reform.

- Plans will abolish the Work Capability Assessment in Great Britain and separate benefit entitlement from an individual's ability to work

- Universal Support announced for England and Wales. This is a voluntary employment scheme for disabled people which will invest up to £4,000 to help get them into work

- £400m plan to increase availability of mental health and expand Individual Placement and Support scheme £11bn added to defence budget over five years - and nearly 2.25% of GDP by 2025. Aim to raise this to 2.5% as soon as possible

- £30m to increase support and housing for veterans £63m fund to keep public leisure centres and pools afloat Charities department to get cash injection of £100m £10m over two years to help voluntary sector with suicide prevention

- Potholes Fund boosted by £200m In Scotland, £8.6m of targeted funding for the Edinburgh Festivals and £1.5m funding to repair the Cloddach Bridge £20m for the Welsh government to restore the Holyhead Breakwater

- In Northern Ireland, £3m to extend the Tackling Paramilitarism Programme and up to £40m to extend further and higher education participation

- Mayors' financial autonomy boosted by agreeing multi-year single settlements for the West Midlands and the Greater Combined Manchester Authority at the next spending review 45% and 50% tax reliefs extended for theatres, orchestras and museums

Sky News overview of the budget BBC News overview of the budget

01995 600600

Call now and book a 60-minute complimentary client review of your business, financial and personal goals.