Currently, chargeable gains made on disposals of residential property are liable to CGT at 18% for any gains that fall within an individual’s unused basic rate band, and 28% where the chargeable gains exceed the unused part of their basic rate band.

Higher rate taxpayers pay 28% on all gains from residential property disposals.

Residential property gains accruing to trustees and personal representatives are chargeable at 28%.

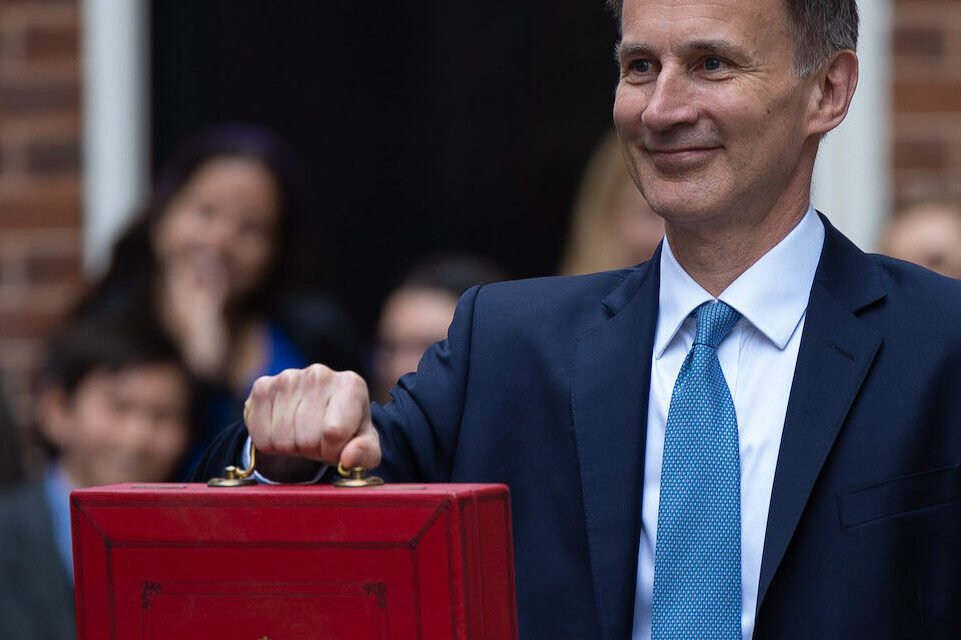

The Spring Budget 2024 brought a reduction in the higher rate of CGT on the sale of residential properties, from 28% to 24%, effective from 6th April 2024. The lower rate remains the same at 18%

Individuals, trustees, and personal representatives who are liable to pay capital gains tax (CGT) on residential property gains may be affected by the change to the higher rate of CGT. Private Residence Relief (PRR) will continue to apply on disposals of main residences.

Cutting the 28% rate of CGT to 24% is expected to incentivise earlier disposals of second homes, buy-to-let property, and other residential property where accrued gains do not fully benefit from PRR. This will generate more transactions in the property market, benefitting those looking to move home or get onto the property ladder.

If you have any queries on how the above may affect you, please do get in touch and we will be happy to help.